Hello

Japanese stood to be the world leaders during 1980-1990 regime in semiconductor manufacturing [2]. During my research, I found that Japanese semiconductor firms are very strong leaders in process which gave them a competitive advantage over others. Situation is bit different today, as we have fabless firms taking the leap, it’s always good to know how things started.

Let me begin with a small example (DRAM) to understand the strong base and deep roots of Japan in semiconductor industry in 1980-90 regime

Concept:

Dynamic RAM (DRAM) is a memory architecture which comprises of a transistor and a capacitor that stores 1-bit of data. Due to its simple structure, a high density can be easily achieved which makes it cheaper and slower compared to Static RAM (that uses 6 transistors to store a bit)

Though it looks simple, but it’s highly process driven (and hence a perfect vehicle to learn about next gen process technology). The learning was also applied on other types of chips like DSP’s, microcontrollers, etc. The reason is the capacitor itself, which if leaks, tends to fade out the information. This needs periodic refresh process (and hence the name ‘Dynamic RAM’)

To protect capacitors from leaking, the transistors used for DRAM cells should be ‘extremely low leakage’ transistors which can be attained using substrate bias.

Next, the transistors threshold should be high in order to have lower leakage (at cost of lower switching time). And (again), attaining high threshold would need an increase in dopant concentration or a bulk bias as is quite evident from below threshold voltage equation:

Threshold Voltage Equation:

Vt = Vto + gamma(square_root(-2phiF + Vsb) – square_root(-2phiF))

Where

Vto = Threshold voltage at Vsb = 0, and is a function of manufacturing process

gamma = body effect coefficient, expresses the impact of changes in body bias Vsb (Unit is V0.5)

phiF = Fermi Potential (dependent on doping concentration)

Japanese DRAM market:

Japanese firms heavily invested in number of engineers to design their 1K and 16K DRAM (reports of 50 engineers for 1K [1] and 100 engineers for 16K [1]), which led to careful attention for fabrication process issues. For eg. sharp vertical walls created while etching, was a concern for lower node technologies as it resulted in inefficient etching of corners for material deposited in later stages. While leading Japanese engineers observed this short-coming and suggested a robust process of having sloped walls rather than sharp vertical walls.

This resulted in higher yields for Japanese producers (up to 68% by 1986[3])

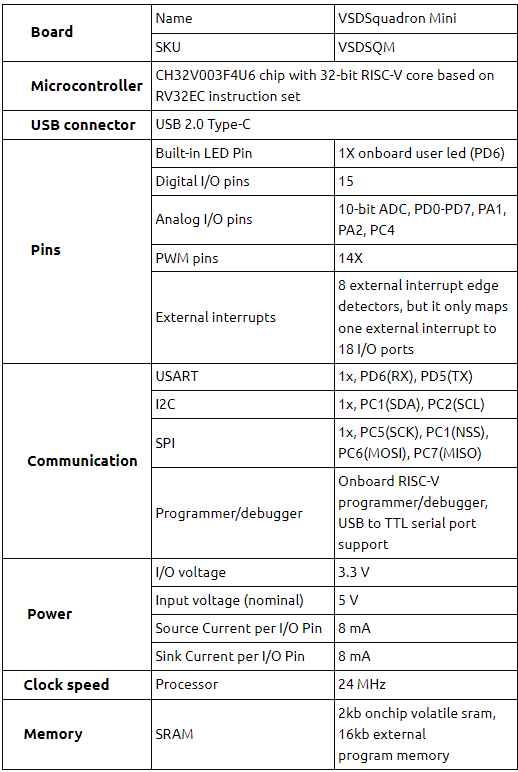

Now this shift in DRAM market very well reflected to overall semiconductor industry. It’s evident from below chart [4], that by 1990, 6 Japanese firms out of top 10 accounted for 38% of semiconductor market share with net of $20.7B out of total semiconductor market of $54.3B

![]()

From above table, we can observe the no. of players moved from 6 to 1. This was the era when other top industries feared of market shift and focused on other segments (like microprocessors, mobile semiconductors, etc.) and became market leaders.

However, Japan still ranks #1 for installed fab capacity, #2 in terms of largest semiconductor material market. More than 50% of semiconductor materials supplied by Japan is being consumed globally and over 30% of semiconductor fabrication equipment are being purchased globally [5]

Notes:

1) “The Decline of the U.S. DRAM Industry: Manufacturing” accessed at https://www.princeton.edu/~ota/disk2…007/900711.PDF

2) “Semiconductor sales leaders by year” accessed at https://en.wikipedia.org/wiki/Semico…_for_year_1987

3) Peter D. Nunan, Sematech, personal communications, May 11, June 23, Aug. 4, and Oct. 10, 1989.]

4) “Why Did Japan’s Semiconductor Industry fall?” accessed at http://marketrealist.com/2015/09/sem…ry-japan-fall/ )

5) “Seven Facts about Japan Semiconductor Manufacturing Supply Chain” accessed at http://www.semi.org/en/node/52146